PM Suraksha Bima Yojana (PMSBY)

Table of Contents

Pradhan Mantri Suraksha Vima Yojana PMSBY ALL INFORMATION READ GUJRATI

IMPORTANT LINKS

CLICK HERE TO OFFICIAL WEBSITE

CLICK HERE TO INFORMATION READ

IMPORTANT LINK

OFFICIAL SITE DETAIL INFO:: FROM HERE

Pradhan Mantri Jeevan Jyoti Beama Yojana Life Insurance Worth 2 Lakh at Just 330

IMPORTANT LINK

OFFICIAL SITE DETAIL INFO:: FROM HERE

ALLPICATION FORM ::FROM HERE

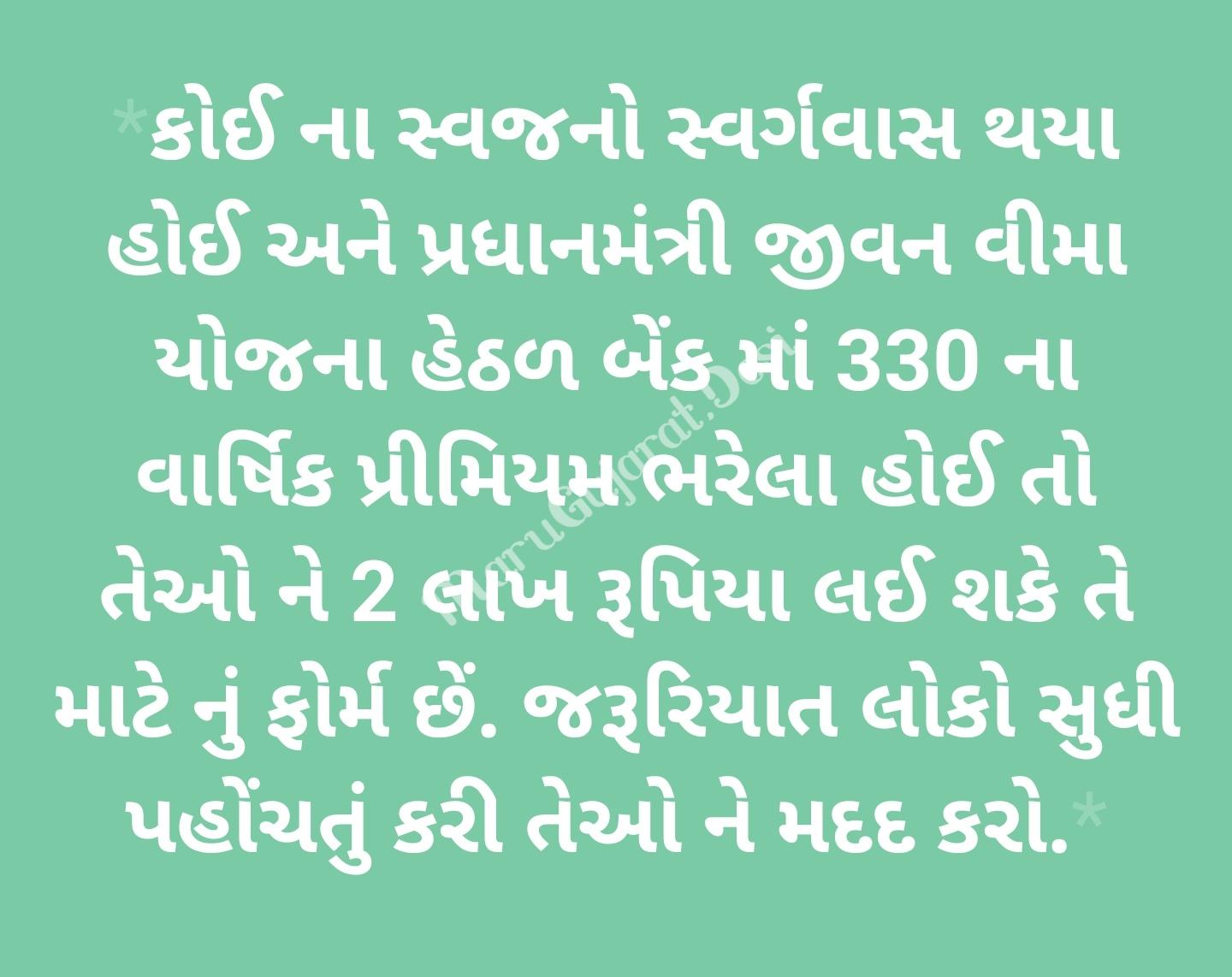

If someone’s relatives have passed away and the bank has paid an annual premium of Rs 330 under the Pradhan Mantri Jeevan Vima Yojana, there is a form for them to take Rs 2 lakh. Reach out to people in need and help them

Pradhan Mantri Suraksha Vima Yojana PMSBY ALL INFORMATION READ GUJRATI

IMPORTANT LINKS

PM Suraksha Bima Yojana (PMSBY)

PM Suraksha Bima Yojana (PMSBY) Form [y] PDF Download at jansuraksha.gov.in Portal

Hello friends, this post is important as we are going to tell you about the process to download Pradhan Mantri Suraksha Bima Yojana application form and claim form. PM Suraksha Bima Scheme is a flagship accident insurance scheme of the Modi govt. launched in FY 2015. Now, PMSBY application & claim forms are available at the jansuraksha.gov.in.

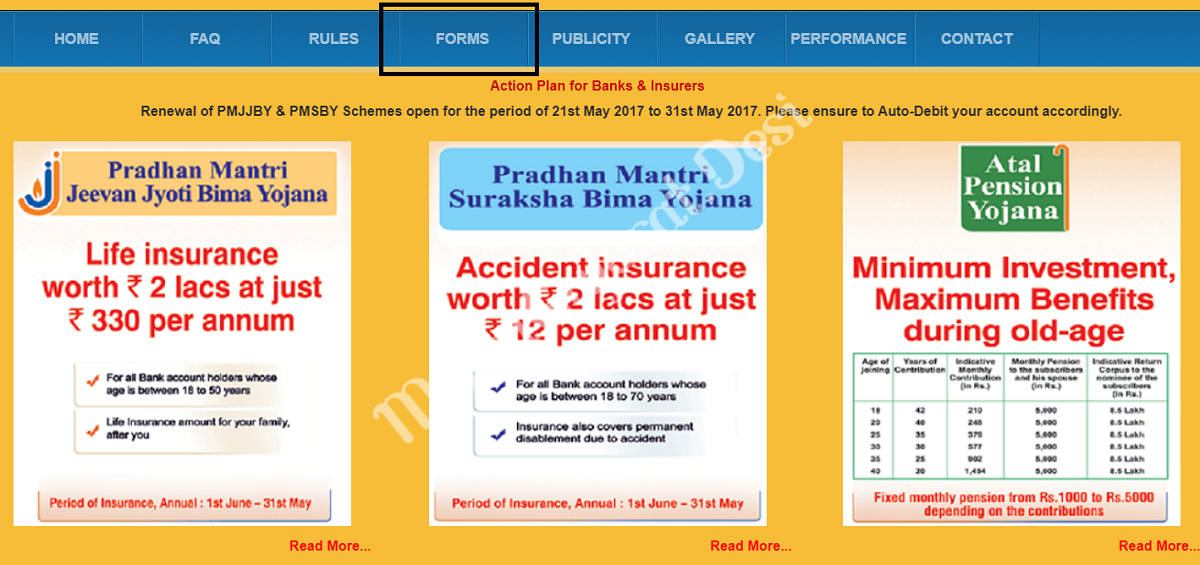

Pradhan Mantri Suraksha Bima Yojana (PMSBY) is a social security scheme offering one-year accidental death and disability cover. The other 2 schemes launched along with the PMSBY scheme are PM Jeevan Jyoti Bima Yojana (PMJJBY) and Atal Pension Yojana (APY).

Under this PMSBY scheme, the central govt. provides accident insurance worth Rs. 2 lakh at just Rs. 12 per annum. Read more to know the eligibility, premium, how to claim, and other details

PM Suraksha Bima Yojana (PMSBY) Application & Claim Form PDF

Below is the complete procedure to download the PMSBY application form and claim form:-

STEP 1: Firstly visit the official Jan-Dhan Se Jan Suraksha website at jansuraksha.gov.in

STEP 2: At the homepage, click at the “Forms” option in the header or directly click https://jansuraksha.gov.in/Forms.aspx

STEP 3: In the new window, click at the “Pradhan Mantri Suraksha Bima Yojana” tab as shown below or directly click https://jansuraksha.gov.in/Forms-PMSBY.aspx

STEP 4: After click at either the “Application Forms” tab or “Claim Forms” tab as shown below. Then select the language in which you want to download the PMSBY application form or claim form.

STEP 5: The PM Suraksha Bima Yojana application form 2020 PDF in the English language will appear as follows

STEP 6: Pradhan Mantri Suraksha Bima Yojana Claim Form 2020 PDF will appear as follows which is available to download through online mode

STEP 7: Candidates can download this application form in PDF format in the language of their choice to avail of PMSBY scheme benefits.

Check PM Suraksha Bima Yojana Scheme Details in order to fill the form and avail of PMSBY Scheme benefits.

PMSBY Scheme Eligibility Criteria

All the candidates must fulfill the eligibility criteria to avail of the PMSBY Scheme benefits:-

- PMSBY is available to people whose age belongs to the age group of 18 to 70 years.

- The aspirant should have an active saving bank account.

- The aspirant will have to sign a consent letter for the auto-debit of the policy premium.

- Any individual can join PMSBY Scheme through one bank account only.

PM Suraksha Bima Yojana accident insurance also covers permanent disablement due to accident.

PM Suraksha Bima Yojana Premium

That is the biggest advantage of Suraksha Bima Yojana, even the poorest of the poor can also afford the premium of PM Suraksha Bima Yojana.

Total Premium: Rs. 12/- per annum per member

Appropriation of Premium:

- Insurance Premium to LIC / insurance company: Rs. 10/- per annum per member

- Reimbursement of Expenses to BC/Micro/Corporate/Agent : Rs. 1/- per annum per member

- Reimbursement of Administrative expenses to participating Bank: Rs. 1/- per annum per member

Auto Debit Facility in PM Suraksha Bima Yojana

It is important to note that the period of PMSBY Insurance is from 1st June to 31st May of any financial year. Once the insurance is availed, a sum of Rs. 12 will be auto-debited from the saving bank account (with an auto-debit facility) of the policyholder. The auto-debit transaction will take place on or before 1 June for the coverage period 1st June to 31st May on an annual renewal basis.

If the auto-debit of premium amount does not happen for some reason on the 1st of June, the insurance plan will be discontinued. The policy will automatically be renewed/re-initiated after the auto-debit of the premium amount from the bank account. Under Pradhan Mantri Suraksha Bima Yojana, risk coverage available is Rs. 2 lakh for accidental death and permanent disability. Moreover, for permanent partial disability, the risk coverage available is Rs. 1 lakh.

Where to Buy Pradhan Mantri Suraksha Bima Yojana

PM Suraksha Bima Yojana is administered through Public Sector General Insurance Companies or any other General Insurance Companies which are in tie-up with participating banks.

You can submit your PMSBY application form to the banker in which you have a savings bank account. The PMSBY form can easily be downloaded from the official Jansuraksha website at jansuraksha.gov.in

Scope of coverage of Suraksha Bima Yojana

- Only one policy will be allowed per person in case the person has more than one saving bank account.

- Aadhar card would be the mandatory and primary document required for getting registered under the scheme.

- The premium of the policy would be auto-debited every year from the saving bank account of the policyholder.

- If a policyholder exit the scheme for any reasons, he/she may get enrolled again from the succeeding year with the same T&C’s

Termination of Suraksha Bima Yojana

There are certain situations when the policy account of the holder will be discontinued/terminated and no benefits would be paid thereafter. Following are those conditions:

- On attaining the age of 70 years.

- Due to the insufficiency of balance in the savings account at the time of policy renewal in subsequent years.

- In case the subscriber is found to be covered by more than one saving bank account and the premium is being paid intentionally. Only one policy cover will remain active and others will be terminated and premium paid will be forfeited.

- If the cover is terminated in cases such as technical or administrative reasons, or due date, the cover can be reinstated on receipt of the full annual premium.

How to Claim PMSBY Accident Insurance Scheme Benefits

PMSBY Scheme aims to cover death caused by accident and disability as confirmed by documentary evidence. This includes road, rail, and vehicular accidents, drowning, death involving any crime (accident reported to police), snakebite, fall from a tree, and other causes supported by immediate hospital records. The complete PM Suraksha Bima Yojana scheme details can be checked using the direct link here – https://jansuraksha.gov.in/Files/PMSBY/English/About-PMSBY.pdf

PM Suraksha Bima Yojana Progress Report

From 9 May 2015 to 30 April 2020, the stats for PM Suraksha Bima Yojana currently stands at:-

Gross Enrollments: 18.54 crore

Number of Claims Received: 50,328

Number of Claims Disbursed: 39,969

Pradhan Mantri Suraksha Bima Yojana Features

Here are the important features and highlights of the Pradhan Mantri Suraksha Bima Yojana (PMSBY):-

- The scheme provides a accidental death benefit of up to Rs. 2 Lakh

- In case accidental death or permanent disability or irrecoverable and total loss of both hands, both eyes or sight or one leg or foot, the insurance cover would be up to 2 Lakh.

- The sum assured would be Rs. 1 Lakh in case of partial disability or lost of one leg, hand, foot, eye or sight.

- The assured amount will be paid to the nominee.

- The scheme will be renewed every year with a single year cover at a time.

It is offered by Public Sector General Insurance Companies or any other General Insurance Company who are willing to offer the product on similar terms with necessary approvals and tie up with banks for this purpose. The banks can engage any insurance company of their choice to offer the scheme.

Background of Pradhan Mantri Suraksha Bima Yojana Policy

Pradhan Mantri Suraksha Bima Yojana (PMSBY), launched in May 2015, is a government backed accidental-death insurance scheme. As of May 2015, only 20% of India’s population has any kind of insurance and this scheme aims to increase this number. Suraksha Bima Yojana is mainly for those people who are not covered under any kind of insurance scheme, especially in the rural areas of the country.

PM Suraksha Bima Yojana is available for all but was launched keeping in mind the people belong to the below poverty line category or under-privileged and those who are not able to afford any kind of insurance plans available with private or even public sector insurance companies.

In case of death of account holders, nominee can claim the insurance cover. For more details, visit the official website at http://jansuraksha.gov.in/